💡(11 Portfolio Updates) What does the “new normal” for 10-year yields imply for portfolios? 👇

👇 Premium Exclusive Insights

Thanks for reading!!!

📌 As my subscriber you get totally FREE my Exclusive Premium Insights that I do and share only with you.

You won't find these materials shared by me on any other platform.

Please, if you wanna reward my work curated for you, share Macro & Business with the link below to your network.

By subscribing you’ll join over 600 people who already read Macro & Business Insights weekly!

(11 Portfolio Updates) What does the “new normal” for 10-year yields imply for portfolios? 👇

The rapid move higher in government bond yields has increased volatility in both equities and bonds.

The S&P 500 sold off by over 1.5% last week, while the Bloomberg U.S. Aggregate bond index was down over 2%.

More broadly, higher yields can increase the cost of borrowing, put downward pressure on stock valuations, and weigh on bond price returns.

WHERE COULD YIELDS HEAD FROM HERE?

From 1990 through 2019 (pre-pandemic), the average 10-year yield has been around 4.5%, so the current range of 5% is only somewhat above long-term averages.

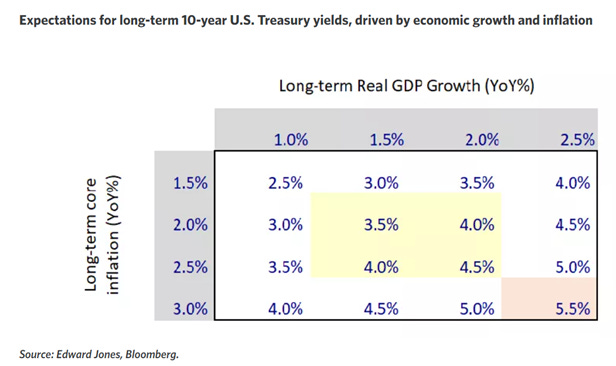

Historically, the 10-year yield can be viewed as a proxy of real GDP growth plus inflation over time.

If we believe the real U.S. GDP growth rate will average 1.5% to 2% and core inflation will settle to around 2% to 2.5%, then the range of the 10-year yield should be around 3.5% to 4.5% long term.

We do believe that over time, 10-year yields will consolidate and eventually peak. This may happen as the Fed and central banks around the globe pause their rate-hiking cycles and over time move rates lower, putting some downward pressure on 10-year yields.

In fact, historically, 10-year Treasury yields tended to peak ahead of or in line with the peak in the fed funds rate.

If we expect the Fed is nearly done raising rates, then yields may be closer to peak levels, as well.

WHAT DOES THE “NEW NORMAL” FOR 10-YEAR YIELDS IMPLY FOR PORTFOLIOS?

This new normal for yields may have implications for both equity and bond portfolios. In equities, with higher yields, we would expect more balance between the growth and value parts of the market over time.

Just as low rates drove investors toward the growth and technology sectors for many years, higher rates may make the better-valuation and higher-dividend parts of the market more appealing.

💌 Sign up to my weekly email newsletter

🎙 PODCAST

Best regards,

Ale

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.