Discover more from Macro Mornings 💡

💡(11 Must Updates) The S&P 500 Index has been resilient in the face of aggressive monetary tightening 👇

👇 Premium Exclusive Insights

Thanks for reading!!!

📌 As my subscriber you get totally FREE my Exclusive Premium Insights that I do and share only with you.

You won't find these materials shared by me on any other platform.

By subscribing you’ll join over 600 people who read Macro & Business Insights weekly!

💡(11 Must Updates)

The S&P 500 Index has been resilient in the face of aggressive monetary tightening 👇

1. “The S&P 500 Index has been resilient in the face of aggressive monetary tightening, a domestic housing recession, an economywide profits recession, secular shifts in the CRE sector, weak global growth, and a barrage of geopolitical shocks.”

2. “When the Fed seemed like it was ready to turn up the heat, it softened.”

3. “Last week several Fed officials reinforced the focus on returning inflation to its 2% target but softened the language by embracing the idea that rising private sector rates did some of the work for them, implying fewer rate hikes were necessary.”

4. Overall, the equity market likes the caution because inflation staying higher for longer implies a more resilient near-term profits cycle and a less tight credit environment.”

REALIZED EARNINGS HAVE ALSO BEEN BETTER THAN EXPECTED

5. “Inflation is only coming down gradually and real growth is holding up further support for the market.”

6. “Revisions to U.S. National Accounts data also showed an upward revision to already high nonfinancial profit margins.”

7. “At this stage, forecasting margins is about figuring out whether labor cost growth or top-line growth slows faster, but the starting point makes the overall profits cycle appear more resilient.”

THE LABOR MARKET HAS BEEN RESILIENT

8. “The labor market is an important transmission mechanism from weaker demand to a deeper contraction and deeper pullback in risk-assets.”

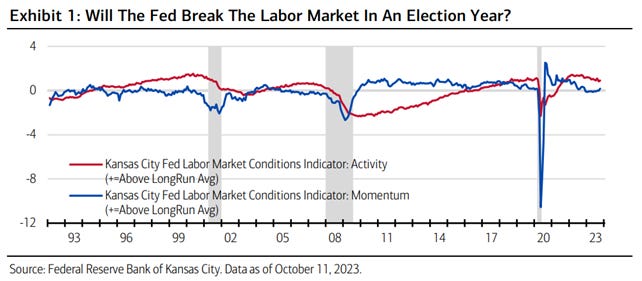

9. “Over the last few cycles, the S&P 500 has been more coincident with labor market data. The Kansas City Federal Reserve summarizes 24 key labor market variables in its Labor Market Conditions Indicator.”

10. “The historical data show that momentum can shift mid-cycle and can move fast, and persistence in declining activity has been typically slower moving late-cycle phenomenon.”

11. “An important question is whether the Fed is willing to break the labor market. (see the chart above)”

📢 If you are here I'm sure you already know these 10 lessons. My goal is to create a financial community that is passionate like you about investing and financial markets, and this guide is just one gift for beginning to master the financial markets.

⚡ I'm sure that you'll have a person in your life that has need to know these 10 investing lessons, so please I'd appreciate a lot if you can share it with them my premium and totally FREE newsletter curated only for you for getting your definitive investing guide 🙏👇👇👇

💌 Sign up to my weekly email newsletter

🎙 PODCAST

Best regards,

Ale

Disclosure

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. This material has been prepared for informational purposes only. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Subscribe to Macro Mornings 💡

Macroeconomic Trends Analysis and Investment strategies. Weekly updates in a clear and concise summary of the most important news.